On the 19th of March, 2025, the European Commission sent Alphabet (Google's parent company) preliminary findings that they are not in compliance with the EU's DMA (Digital Markets Act). Citing the DMA's clause against self-preferencing, the European Commission are stating that Google is not doing enough to ensure that its own services aren't being treated more favorably than those of the third parties it works with.

This is the latest step in the long process of the DMA’s enforcement in the EU, and it’s definitely not the last. And it's not just the DMA - back in January 2025, the UK’s Competition and Markets Authority Act (CMA) kicked off an investigation into Google’s search and search advertising, assessing whether Google holds strategic market status (SMS) and if its practices harm competition and innovation. Globally, there have been other clear challenges to Google’s power recently, including sanctions proposed by the United States Department of Justice with the goal of stopping Google from monopolizing the search market – with arguments scheduled for April 2025.

For years, hotels have relied on Google's ecosystem—whether through organic search, paid advertising, or metasearch visibility—to drive direct bookings. However, as regulations tighten, Google's ability to prioritize its own services and ad placements could be restricted. This could theoretically lead to a more level playing field where smaller hotel brands and direct booking platforms gain better visibility without having to outbid major Online Travel Agents (OTAs).

In practice, it’s a bit more complicated. With new regulations potentially limiting Google’s search functionalities, hotels could face increased competition from OTAs, who are not held to the same regulations as Google and may invest further in their own marketing channels to capture displaced demand (though Booking.com – still the biggest global OTA – is facing its own DMA-related regulatory challenge).

Google’s changes in the wake of the DMA

Since being named a DMA “gatekeeper” by the European Commission back in November 2023, Google has made a number of changes to its search engine in order to satisfy all the requirements of this landmark act. These have included removing links to its own vertical search services (VSS) and changing the user experience on its EU search engine results pages (SERPs) to deprioritize its own offerings. Google (perhaps unsurprisingly) frames these changes as “removing useful features … and reducing functionality”, though there is certainly debate as to whether they’ve had the desired effect of increasing fair competition between businesses and improving options for end users.

With this newest news from the European Commission, Google are doubling down on their messaging that the further enforcement of the DMA will only hurt European businesses and consumers. In a blog post released after the news hit, Google highlighted that European businesses are already losing up to 30% of traffic, stating:

The DMA is designed to regulate large platforms like Google, Apple and Meta, and boost competition, but in reality, it is having the opposite effect by hurting European businesses and consumers.

Oliver Bethell, Senior Director, Competition at Google

Given this newest challenge by the European Commission, there will be more DMA-driven changes to come -- but Google are still figuring out what those could look like. In late 2024, Google ran a test in Germany, Belgium and Estonia that took their search results back in time, in response to criticism by some industry players that previous changes haven’t gone far enough.

What changes did Google test?

In this test Google removed many of the features that have been seen as standard on the search engine for years, including maps, reverting back to its old approach of simply showing a list of links.

This return to the “old ‘ten blue links’ format from years ago” didn’t last long and looks like a deliberately provocative move to illustrate where hard-line interpretation of the DMA could lead. After all, not every search optimization or design change warrants a dedicated blog post from a senior member of Google’s legal team (in this case no less than the Director, EMEA Competition). But nonetheless, it was an interesting sign of what the future could look like.

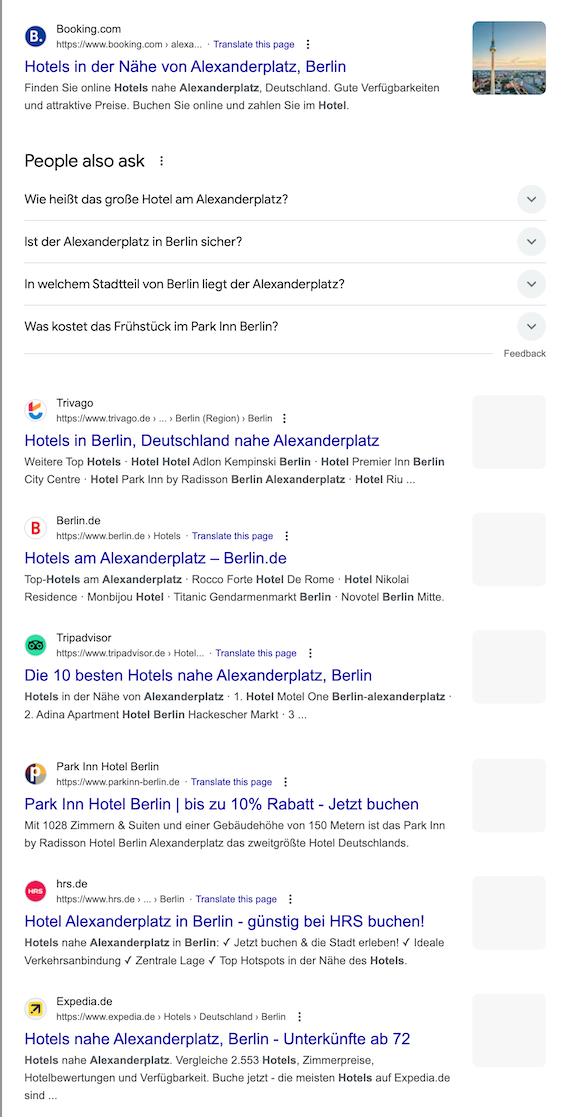

We had a look at the search engine results pages for the EU as a whole, and for the countries impacted by this test. When looking at specific hotel name search (i.e. “Radisson Blu Berlin”, we did not see a marked difference in the results shown. However, when looking at more general terms (ie “hotels in alexanderplatz Berlin”), the lack of additional visuals and graphics was striking. The page definitely started to look more like the Google of a decade ago - no maps, images or additional hotel creatives leading to booking options. However, this distinction was presumably a design choice by Google for the purposes of bounding the test, rather than a conceptual limitation.

EU SERP example

Test country SERP example

Did these changes impact Google’s performance in the affected regions?

When Google implemented some of its other changes in accordance with the DMA, we saw significant changes to hotels’ metasearch performance, with impressions and clicks dropping by as much as 30% in some cases. Did these changes have a similar impact?

In a blog post, Google shared the results that they saw from implementing these newest tests, including:

- Less satisfaction from users when making Google searches, and longer search journeys to find hotels – in addition to abandoned search journeys.

- More than a 10% drop in Google traffic to hotels in the impacted region

- Relatively flat traffic to intermediary sites like Booking.com

Google is inherently biased in this case, but there’s reason to think that these changes could in fact cause a drop in traffic going to direct hotel websites in the future.

Google: No longer a worldwide experience

Google’s DMA response has already led to a significant gap opening up between the experience of users looking for hotels within the US, and those in other parts of the world.

Of course, Google is famous for constantly testing, refining and optimizing all its products, so no two geographic experiences were ever quite the same. But it’s possible that this gap will get even bigger in future. It simply might not be legal to roll out design changes made in other parts of the world to users in the EU – and maybe now the UK -- no matter how effective they appear to be.

For example, in December 2024 we temporarily saw a big change to Google’s metasearch results being shown to a significant chunk of US users. This test has since ended, but if implemented on a larger and more permanent scale, it could significantly impact the way that hotels are displayed on metasearch.

Google’s DMA approach vs. Booking.com’s DMA approach

Google has been engaging with the DMA for over a year now, and is still making meaningful changes to ensure compliance with the law. Booking.com released its first compliance report in November 2024, after being named a gatekeeper back in May 2024, and the changes suggested were minimal in comparison. The wording of the law is definitely more geared towards a platform like Google, which shows its own offerings alongside those of third parties, vs. a closed system like that operated by Booking.com.

One of the main aims of the DMA was to enable smaller businesses (like independent hotels) to compete more effectively with larger players. So far, that seems to have backfired somewhat. While the DMA is enacting control on huge players like Google, Meta and Apple - it’s not being used effectively to rein in the power of other large companies like OTAs. And in fact, with Google required to not self-preference, these large OTAs are often actually gaining more visibility on its site at the expense of direct booking links - including in the case of Google’s recent test of the “return to blue links”.

The European Commission’s newest challenge to Google makes it very clear that they’re taking the enforcement of the DMA very seriously when it comes to the search giant. We hope that the wording of the DMA doesn’t keep Booking.com from being held to the same standard as other gatekeepers as the act becomes a cornerstone of the EU’s business landscape.

What’s next for Google?

According to Google's recent blog post: "We will keep engaging with the Commission and comply with its rules. But today’s findings now increase the risk of an even worse experience for Europeans."

It’s hard to predict what changes Google will test next, and how they'll continue to be impacted by incoming rules and regulations. And in the case of the UK’s CMA, we’ll likely not have any firm answers until the second half of this year, with an official October deadline for the investigation.

In the meantime, we’ll be keeping an eye on the DMA’s rollout, the US Department of Justice investigation, and any other upcoming regulations – and evaluating how these changes could impact hoteliers. When in doubt, please reach out to one of our direct booking experts for any guidance, advice, or insights.

Get in touch with our experts today for more insights into news affecting the hospitality industry.

Genevieve is a product marketing manager at Triptease.