“Hi Booking.com 👋 You never cease to surprise me…”

That was the opening line of a recent Linkedin post that kicked off an in-depth discussion on the topic of Booking Sponsored Benefits. The OTA’s rate discounting program has been around for a while, but many hoteliers are still puzzled to find that their properties are discounted on Booking.com without their prior consent.

In 2019 we published a report asking whether the hotel industry was on the verge of a parity nightmare. Back then, it was the launch of Booking.basic that provided a wake-up call to those hotels still not taking control of their downstream distribution. Various other discount programs followed suit -- the Early Payment Benefit, Genius rates, Booking.com loyalty promo codes, and most recently Booking.com Flash Deals.

This ongoing roll-out of rate discounting promotions by Booking.com may in itself be nothing new. However, at a time when hotels have never needed more support from their distribution partners, is it fair that some OTAs continue to solidify their own market share at the expense of a recovering hotel industry? Where should a hotelier draw the line, and what exactly constitutes a fair Hotel-OTA partnership?

Who pays for Booking Sponsored Benefits?

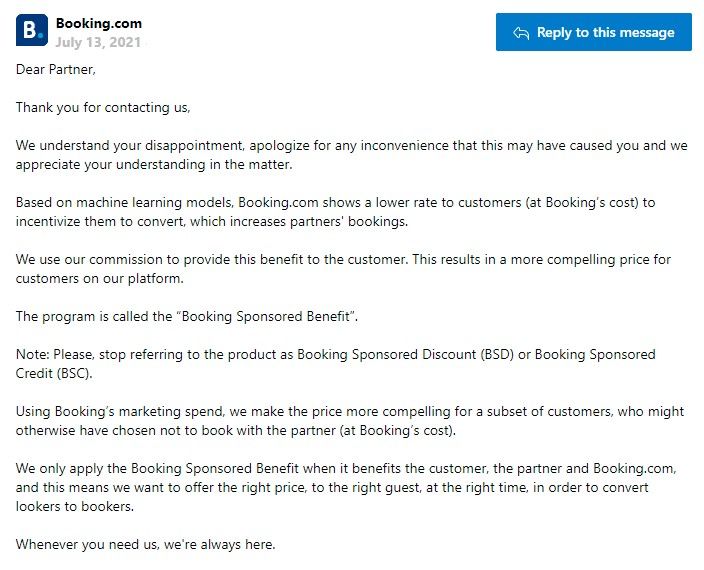

In an email shared in the LinkedIn post mentioned above, a Booking.com representative explains that the OTA uses its own commission to provide this benefit to the customer. According to their official reply, this comes at no cost for the partner hotel.

The hidden cost for hotels

Unfortunately with OTA promotions of this type, there’s always a cost for hotels. The impact on your rate parity and all that comes with it: lower click-through-rates on metasearch and lower direct conversion rates.

So how exactly do Booking Sponsored Benefits work in practice and what is the result for hotels? In short, a customer can choose to pay in advance via Booking.com and enjoy a discounted price of $90 for instance (compared to a direct rate of $100). Then, the hotel gets sent a Virtual Credit Card equivalent to the $100 original rate, based on which booking.com charges their commission (for instance $100 * 18% = $18). This commission of $18 is then used to discount the price to the guest.

One way to present what’s happening here is to say that Booking.com has squeezed their own margin to offer better prices for guests. But with the hotel left with little choice other than to accept the Virtual Credit Card after their room has already been sold at a discounted price, this setup lacks transparency and robs the hotelier of control over their own rate distribution. The hotelier has essentially helped booking.com undercut them for their very own rooms.

The immediate question that many hoteliers have asked is -- how do we opt out? It is not obvious but it is possible. The hotel has to turn off the online payment method and cease the virtual credit card payment option. From the conversation happening on LinkedIn, it seems this is a quick fix that hoteliers strongly encourage each other to adopt.

However, the very fact that the hotel was auto-enrolled in one of Booking.com’s many discount programs without their permission is a reminder of how little control hotels have in the face of OTAs. This raises long-term concerns over the nature of the hotel-OTA partnership.

What makes a good partner for hotels?

Asking for permission and providing transparency

Major OTAs will always try to find ways to offer their users the best possible price, no matter what it takes. They have the scale and the budget to constantly experiment with new features geared towards making their platform more attractive to guests and to encourage brand loyalty. Hotels should question at what point that experimentation crosses the line to become a soft launch of semi-permanent features. This seems to be the case with Booking Sponsored Benefits.

As ever, it is up to the hotel to enforce rate parity across their OTA partners and to demand transparency and clarity on everything that involves their brand. It should be only fair to expect a healthy business partnership that respects the voice of all stakeholders. We spoke with Thibault Catala of Hotel Revenue Management Catala Consulting, author of the original LinkedIn post and an expert on what underpins a solid hotel-OTA partnership. He emphasized the need for permission. OTAs should ask the hotelier for explicit permission when making changes to their agreed rates. ‘Giving your partner the sense of control is key for a healthy partnership,’ he said. He also offered the following advice to hoteliers:

"Don’t be afraid to ask questions to your OTA. Ask your account manager why -- why my property shows this rate on your platform. You have the right to ask about everything that involves your property and the rates associated with it, don’t forget this. You are the one to ensure that branding of your property on OTAs is in line with what you want."

Thibault Catala - Hotel Revenue Management Catala Consulting

Ask your OTA to be transparent about their experimentation, then enforce a rule that you need to pre-approve enrollment into anything that involves the representation of your hotel brand on their platform. It is the only way to protect your rate parity, your reputation and ultimately the control of your distribution.

Collaboration not competition

“They call us a partner but they don’t act as a partner”. This comment from the Linkedin post underlines how hotels often feel. A supportive distribution partner works with a hotel collaboratively to sell rooms as widely as possible for the agreed price. Stepping outside of these boundaries puts the hotel and the OTA in direct competition.

When programs like Booking Sponsored Benefits shift the power to control price entirely to the OTA, this becomes less simple competition and more a potential infringement of contractual rights. With some OTAs also penalizing hotels who fail to meet the OTA’s price parity demands of them, the power imbalance becomes startlingly clear.

We have previously explained why parity feels like a battleground. While some healthy competition between different OTAs is to be expected, competition between OTAs and their partner hotels is not acceptable. Some hotels have been fighting back against the unfair competition that OTAs are instigating. Most recently (June 2021), Spanish hotels (namely the Madrid Hotel Business Association and the Spanish Association of Hotel Directors) raised a claim to competition authorities to investigate booking.com pricing practices. A month earlier (May 2021) German hotels won a court case against booking.com, allowing them to offer better direct prices. But as some hoteliers put it, these favourable legal decisions feel like ‘winning a battle, but not the war’. As Thibault Catala said,

"There is an urgency to act in collaboration; both among hotels and between hotels and OTAs. If we continue in this fighting mentality and undercutting game, this thing will explode to the detriment of everyone in the sector."

Tools that work for you, not just for them.

“Having the right tools, the right experts, the right know-how on the hotel’s side is key to cultivating awareness and acting swiftly,” says Thibault Catala. At Triptease our aim is to equip hoteliers with the right acquisition and conversion tools to empower their direct booking strategy. A good partner should provide a hotelier with data insights, guest intelligence and tools that help them make the best decisions for their property and brand by themselves. If your OTA relationships don’t provide this, get in touch with the team at Triptease to build a strategy that puts you back in control.

Would you like to speak with one of our direct booking experts about how the Triptease Platform could help you? Get in touch via the form below.